Money & Time Saving ideas and Suggestions for Buyers and Sellers.

Buying a home is expensive.

Here are some money saving tips to help make home ownership more affordable. By combining many of these tips, the money saved can make home ownership easier. These tips also applies on ways to help Sell your home to potential buyers.

Use a Real Estate Professional

Using a trained Real Estate professional can help you properly price your home correctly so that it will attract buyers, as well giving advice on the best time of the year to put your home on the market. The Real Estate professional will market your home, handle inquiries about your home, organise Open Houses, arrange viewings and book appointments with buyers and assist you in negotiating the sale of your home or property. The Real Estate salesperson can also assist you with making your home more attractive to buyers such as using a Home Staging Company to market your home to simple things such as reminding you to make sure your lawn is cut.

A Real Estate professional can assist the buyer in locating a new home or property, assisting in obtaining services such as a lawyer, Home Inspector and Mortgage Broker. And the Real Estate professional will help you negotiate the purchase of your home and guide your through all of the conditions that must be met in order to complete a purchase and to transfer ownership over to the new owner. All of the above are very time consuming and most people do not have the time to do all of these task by themselves.

Consider Using a Mortgage Broker

When you decide to buy a home, one of the first steps should you should do is to get a pre-approved mortgage. Having a pre-approved mortgage will allow you to know much you can afford to purchase a home or property.

Many people have traditionally chosen a Bank to obtain a mortgage for a home purchase. An option to using a Bank to obtain a mortgage is to go to a Mortgage Broker. A Mortgage broker can help you decide on whether to chose between a closed or open mortgage, and whether to pick a fixed or variable borrowing rate. However, it is both wise and prudent to shop around and interview at least three different Mortgage Brokers to find the one that best suites your needs. This rule of "Three" should be used for any type of professional services that you are using so that you are not relying on just one opinion. Our Brokerage can supply you with a list of local Mortgage Brokers to choose from.

A home is a large investment so you do want to take your time to get the best mortgage plan and rate available.

Closed term mortgages are usually the better choice if you're not planning to pay off your mortgage in the short term. Interest rates for closed term mortgages are generally lower than for open term mortgages.

In regard to OPEN Mortgages; if a borrower has extra money available they are allowed to pay down a portion of the mortgage with a Lump Sum payment which reduces the length of time it takes to pay off the mortgage. This Lump Sum payment goes towards the principle, and not the interest. Interest rates for open mortgages are generally higher than for closed mortgages because of the added pre-payment flexibility. A Mortgage Broker can help explain the details of this money saving procedure.

A Mortgage Broker also has the flexibility of searching for the best mortgage rate. A Bank on the other hand will want you to chose one of their rates and mortgage types which may not be the best in terms of paying down your mortgage in a timely and affordable manner. However, the bank may also compete with your selected Mortgage Broker to get your business once they know you have other mortgage options.

Banks on the other hand, do compete with other Banks so you can shop around from Bank to Bank to get the rate and plan that suites you best.

The following is a short video on Youtube that was made by Scotia Bank that briefly discusses how to save money and time on a mortgage.

Source: Scotia Bank. https://youtu.be/L_rIIH_p-HM

More on Mortgages:

The following information about mortgage types is copied from the Ottawa Mortgage Brokers site:

There are many different types of mortgages available, so before you choose, here’s some information you will want to know.

Conventional / Low Ratio Mortgages

A mortgage where the down payment is equal to 20% or more of the property’s value/purchase price. A low-ratio mortgage does not normally require mortgage protection insurance.

High Ratio Mortgages

A High-Ratio Mortgage is one where the borrower is contributing less than 20% of the value/purchase price of the property as the down payment. These types of mortgages must have mortgage default insurance through Canada Mortgage and Housing Corporation (CMHC), Genworth Financial or Canada Guarantee; the three mortgage insurance companies in Canada.

Open Mortgages

An open mortgage allows you the flexibility to repay the mortgage at any time without penalty. Open mortgages usually have shorter terms, but can include some variable rate/longer terms as well. Mortgage rates on Open Mortgages are typically higher than on Closed Mortgages with similar terms.

Closed Mortgages

A closed mortgage is a mortgage agreement that cannot be prepaid, renegotiated or refinanced before maturity, except according to its terms.

Fixed Rate Mortgages

The interest rate of a fixed rate mortgage is determined and locked in for the term of the mortgage. Lenders often offer different prepayment options allowing for quicker repayment of the mortgage and for partial or full repayment of the mortgage.

Variable Rate Mortgages (VRM) / Adjustable Rate Mortgages (ARM)

These types of loans differ from a fixed rate mortgage in that the mortgage rate may be changed during the term of the mortgage. Generally, these mortgages are initially set up like a standard loan, based on the current interest rate. The mortgage is reviewed at specified intervals and if the market interest rate has changed, either changing the size of the payment or the length of the amortization period (or a combination of both), the lender then alters the mortgage repayment plan.

Source: Mortgage Brokers of Ottawa. http://www.mortgagebrokersottawa.com/mortgage-solutions/different-types-of-mortgages/

Use a Home inspector.

Using a competent Home Inspector can save you both time and money on a home purchase. If a home has too many problems a Home inspector can identify them and present you with a report on how much it would cost to fix the problems. The cost and time may be too much to consider the property and an option would be to refuse to purchase the property. Another property may have few problems and the Home Inspector's report would then give you confidence in making a home purchase. Or, the Home Inspector's report may be used to get a lower price if a list of problems are found during the inspection. A Clause can be added to an Offer to Purchase agreement stating that the offer to purchase is conditional on a satisfactory Home Inspection. For sellers, using a Home Inspector can help you determine if any upgrades or repairs are required to put your home into a more "saleable" condition. I can provide my clients with a list of Home Inspectors upon request.

Work From Home.

If you have the flexibility to work from home then not only can you save money on commuting costs, but you also have the choice of moving farther from the centre of the city where prices are cheaper. You can also investigate moving to a smaller town, particularly those that have added services and features such as schools, health centres, shopping, and commuting services such as rail or bus system.

Longer Distance Commuting.

Some people choose to live in smaller towns, and then to use various forms of public, or private transit such as Commuter Rail, VIA Rail, car Pooling and Bus services.

The advantage of doing this is that homes and properties will be cheaper in smaller town than in larger cities. Some towns also have better services than other towns, so that depending on the personal requirements a person has, some smaller towns and rural homes are more suitable for some people than for other people.

For example, one town may have a high school, while another town requires a school bus to transport students to a regional school. Other towns may be on a passenger rail line, and have direct access to a larger city. In the case of a city like Ottawa, the towns of Casselman and Alexandria have a VIA Rail station where there is daily morning service to Ottawa, as well as daily afternoon service from Ottawa east towards those two towns. Both of these towns also have very good commuter bus services to and from Ottawa and Gatineau. Alexandria as an example, as has a high school and a hospital making it a place where many needed services are locally based.

Taxes may be cheaper, or more expensive in smaller towns. The reason is that some towns that have lost their manufacturing base (E.G. Smith Falls and Cornwall) have also lost that industrial tax revenue, which must be made up through an increase in home owner property taxes. Our realtors can help our clients with property tax information of the various smaller town in eastern Ontario.

If buying a New home make sure the roof is anchored properly. Or retrofit your existing home to withstand high winds.

Wind damage is one of the main causes of damage to homes in Canada.

Initial construction is where to make homes stronger.

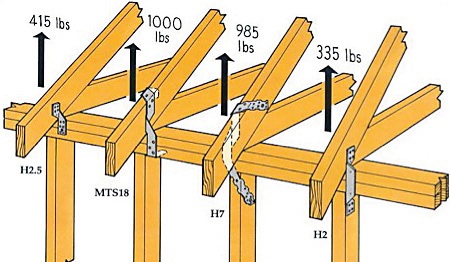

While Net Zero homes are the are desirable, what we need are homes that are also more resilient to external fores such as severe wind. To make new homes more resilient to severe wind the roof needs to be fastened with a minimum of 3 Toe Nail connections. A toe nail is a nail placed at a 45 degree angle. The builder must also move from 2 inch to 2.5 inch screw nails to make the connections more secure. Adding these extra construction requirements only adds about $250.00 to the build cost of a new home (Source: Dan Sandink Director of Research Institute for Catastrophic Loss Reduction. Presentation at NCC panel on Adapting to Extremes Climate change projections and urban adaptation. Urbanism Lab. January 22, 2020, Ottawa.).

Even if you are buying a new home a Realtor can help you ask the right questions of the builder, and help you ensure that you purchase the home that is built to withstand the various effects of weather that we experience here in Canada. Contact us to arrange to have a Realtor negotiate a new home purchase on your behalf. info@smartcityrealty.ca

Toe Nail.

Toe Nail.

Source: https://www.familyhandyman.com/carpentry/toenailing-basics/

The following information comes form the "Institute for Catastrophic Loss Reduction":

Choose a high-wind rated roof cover and make sure ridge and off-ridge vents are also rated for high winds. If a homeowner is not ready to re-roof, check vents to be sure they will stay in place and are of the proper type and strength to resist high winds and wind-driven rain.

Shutter any vents before a storm strikes or replace them with products rated for resistance to wind-driven rain intrusion. If water accumulates in the attic, homeowners could soon find themselves facing problems with

mildew, mold and rot. Strengthen the fastening of the roof sheathing to the roof structure and provide a secondary water barrier by having a closed cell urethane-based adhesive spray foam applied from inside your

attic. Gable end roofs are more susceptible to damage from high winds than hip roofs or flat roofs because they slope in only two directions (and not four). The gable end presents a large obstacle to the wind and receives its full force. If the framing of the gable end and the rest of the roof is not adequately braced to resist the wind, the

roof can fail. Roof failures, especially in unbraced gable roofs, are a common cause of major damage to houses and their contents in high winds.

Hurricane Straps

Hurricane Straps

A gable roof can be strengthened by installing additional braces in the trusses and/or at the gable ends. A qualified builder can also install galvanized metal hurricane straps. These help to secure the roof to the walls. Large gable end walls should be braced and tied into the roof and ceiling structure to keep them from being damaged during a violent storm.

Some examples of metal hurricane straps.

Source: https://www.iclr.org/homeowner/

Public Transit and Car Sharing.

If you do not need a car to drive to work, you may not need a car at all.

You can use Public Transit for transportation to and from work, your cost of living will be drastically reduced since owning a car is VERY expensive.

According the Ottawa Car Sharing site Vrtucar:

"Based on 2014 CAA figures, the cost of owning and operating an economy-size car, including fuel costs, financing, license, repairs, maintenance and depreciation is $9,861 per year, or $822 per month. Compare that with the average VRTUCAR driver, who spends about $852 per year, or only $71 per month! " (http://www.vrtucar.com/en/faq/#4).

Another alternate to car ownership is Car Sharing.

This quote is again from Vrtucar in Ottawa;

"Use a car when you need it! Reserve from our fleet of well-maintained, conveniently-located cars. Use the car for as little as half an hour, up to several days.

We take care of the burden of vehicle purchase and financing, licensing, routine maintenance, repairs, insurance and fuel costs for you! VRTUCAR members help reduce harmful emissions into the environment by over 50% per member on average by car-sharing. Every shared VRTUCAR replaces 6-8 private cars on our roads. VRTUCAR’s fleet of cars is newer, and more fuel efficient, as well. For the community, car-sharing means cars will take up less space on streets, fostering more pedestrian-friendly and child-friendly areas in which to live. Car-sharing also provides access to a safe, reliable car for those in our community who may not be able to afford the cost of car ownership." (http://www.vrtucar.com/en/faq/#1).

I personally recommend Vrtucar since I am a member and use it as well my own car.

More information about Vrtucan can be found on the Vrtucar site : http://www.vrtucar.com/

Rent out a room or basement apartment in your home

This can be an option if the home already has a legal in-law suite, or if you are willing to renovate surplus space to meet local zoning and building code requirements.

Potential income in the range of $600 to $1,300+ per month for a bachelor Apartment (Source: Genworth Canada Home Ownership Spring summer 2017).

List your Home on a Peer to Peer service Like AirBNB

You can rent a room, or even the whole house for short term accommodations for tourists.

Potential average expected Income for a One room rental in a large city is $128 ( Source: Genworth Canada Home Ownership Spring summer 2017).

Use a Low Cost Internet Service Provider

It seems that everyone needs some type of Internet Service where they live. There are some Internet Service providers that provide Internet access at cheaper rates than the major companies. A search of the Internet Service Provider marketplace will produce a result of many of these lower cost Internet Providers. One such Low Cost Internet Provider that I use is the National Capital Freenet that serves the Ottawa area. The National Capital Freenet offers both Dial-up and High Speed Internet Access. Rates for their regular High Speed service starts at $32.95 a month. Note: The National Capital Freenet (also known as the NCF) requires either an active or inactive telephone line. More information about the National Capital Freenet can be found here: https://www.ncf.ca/

Over the Air TV (OVTA TV)

Now that Television stations in Canada broadcast in High Definition (HD) it is a viable alternate to Cable, Fibre or Satellite TV. In areas such as Ottawa there are 15 High Definition signals that can be picked up by a High Definition antennas, and a modern Television that can receive an HD signal. There are also converters available that allow older televisions to receive the new HD signal. Depending on you location and if you also use a roof top antenna, you may also be able to receive distant television signals.

HD Over the Air TV is FREE.

If a person chooses to get their television from Over The Air TV instead of Cable, Fibre, or Satellite then the monthly savings can be substantial (Depending on your monthly plan).

A one year savings by switching to FREE OVTA TV can be considerable.

The following is a list of HD TV stations available in the central part of the City of Ottawa:

- CBC (English) 25 4.1

- Global 6 6.1

- CBC (French) 22 9.1

- CHCH 33 11.1

- CTV 13 13.1

- Omni1 27 14.1

- TVO 24 24.1

- TQ - 30 30.1

- TQS (V) - CFGS 34 34.1

- TVA - CHOT 40 40.1

- CTS 42 42.1

- CHRO 43 43.1

- Omni2 20 60.1 60.1

- CityTV 17 65.1 65.1

Information about Over The Air TV can be found on the Internet. Here is a link to one site that lists OVTA around the City of Ottawa:

http://www.otacanada.com/cgi-bin/ota_info.pl

Lease your Roof to a Solar Energy Company

You can support clean energy while making money at the same time. This may not be an option if your roof is in need of maintenance.

Potential income: From $200 to $1200 peryrear ($300 to $450 is the average. (Source: Genworth Canada Home Ownership Spring summer 2017).

A Home Garden

At one time one of the reasons to buy a home with land was to have your own vegetable garden. The American nonprofit National Gardening Association produced a study in 2009 -- sponsored by ScottsMiracle-Gro Co. -- that found the average family with a vegetable garden spends just $70 a year on it and grows an estimated $600 worth of vegetables.

George Ball, chairman and CEO of seed giant Burpee, can rattle off the savings for dozens of homegrown crops. Green beans will generate US$75 worth of crops for each $1 you spend on seeds, Mr. Ball calculates. Even the lowly potato will generate $5 of spuds for each $1 you invest in seeds.

Lori Bushway of Cornell University's Department of Horticulture says a garden can be as simple as digging up a few square feet of your lawn and sprinkling lettuce seeds in the dirt.

Lettuce for example, is easy to grow and even a small space measuring 8-by-4-foot (raised bed and filling it with compost) can fill salad bowls in your home for about six weeks.

Ms. Bushway advises planting four square feet of lettuce per person in your household. Source: http://www.wsj.com/articles/SB123983924976823051

Rent out your Parking spot

If you have unused parking space this can be an option for extra income.

First check with the local zoning to see if this is allowed in your neighbourhood.

Potential income: $140 per month (a Big City Average) Source: Genworth Canada Home Ownership Spring summer 2017.

=========================

Michael Kostiuk. Broker of Record.

Smart City Realty Inc Brokerage

info@smartcityrealty.ca

613-663-2545

www.smartcityrealty.ca